Current payout target p.a.

The current payout target is the estimated amount of money you will receive on a regular per annum basis from your Passive Income portfolio. It is is calculated based on the target fixed and variable coupons/dividends of the underlying funds in the portfolio.

The payout takes into account fund-level fees but excludes the Endowus fee. It also does not account for any cashback that you might receive from trailer fees.

For example, if you invest S$100,000 and the portfolio’s current payout target p.a. range is 4.0% to 5.0% p.a., you’ll receive an estimated S$4,000 to S$5,000 p.a. paid out throughout the year, before any Endowus fee charge or cashback that you might receive.

Disclaimer:

Current payout target is not guaranteed and is an estimate only. Your principal invested amount may or may not be returned in full. This is subject to market movements and fund manager’s decisions that are outside the control of Endowus and therefore may not be realised in the future.

Max drawdown and historical loss

While our Income Portfolios are created with the best-in-class fund management companies in the income investing space, there is still risk involved and investments are not capital guaranteed.

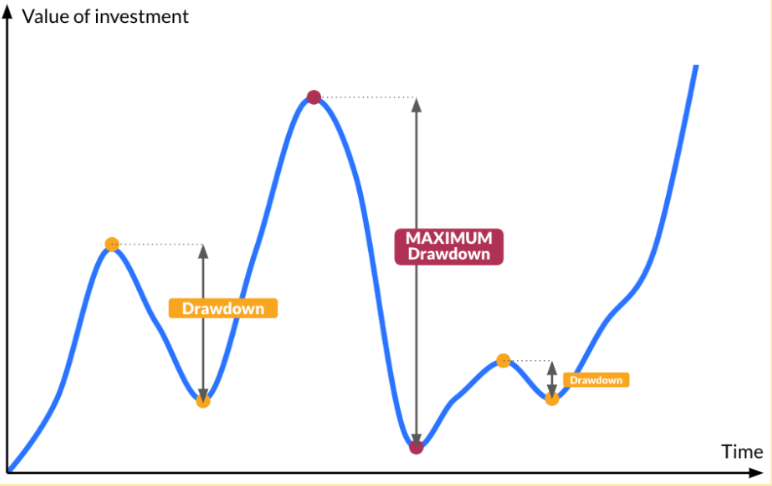

Understanding the historical maximum loss of the respective portfolio can be a good way to assess whether the portfolio is suitable for your risk appetite. Historical maximum loss (“drawdown”) is the fall from the peak (the highest point) to trough (the lowest point) in investment value, based on historical performance.

Investors may use the historical maximum drawdown as an indication of the maximum loss they may have experienced by investing in the specific portfolio over a period of time.

Please note that the drawdown figure is based on historical performance, which may not be indicative of future performance. There is always the risk that the latest maximum drawdown will be overtaken by a new maximum drawdown in the future. Investors should therefore view the historical maximum drawdown as a reference point and not a guarantee of future maximum loss.